Trading cryptocurrency has become a global phenomenon, attracting both seasoned investors and curious newcomers. The volatile nature of digital assets offers opportunities for significant profits, but also carries inherent risks. Whether you’re looking to diversify your portfolio or capitalize on market fluctuations, understanding the fundamentals of crypto trading is crucial. This comprehensive guide will provide you with the knowledge and tools to navigate the exciting world of cryptocurrency trading effectively.

Getting Started with Crypto Trading

Understanding Cryptocurrency Basics

Before diving into trading, it’s essential to grasp the fundamentals of cryptocurrency.

- What is Cryptocurrency? Cryptocurrencies are digital or virtual currencies that use cryptography for security. They operate on a decentralized technology called blockchain, meaning they are not controlled by a single entity like a central bank.

- Popular Cryptocurrencies: Bitcoin (BTC) is the first and most well-known cryptocurrency. Ethereum (ETH) is another popular choice, known for its smart contract capabilities. Other notable cryptocurrencies include Ripple (XRP), Litecoin (LTC), and Cardano (ADA).

- Blockchain Technology: Blockchain is a distributed, immutable ledger that records all transactions. This transparent and secure technology is the backbone of most cryptocurrencies.

- Example: Imagine Bitcoin as digital gold. Blockchain acts as the public record book that verifies every Bitcoin transaction, ensuring its authenticity and preventing fraud.

Choosing a Crypto Exchange

Selecting the right crypto exchange is a critical first step.

- Factors to Consider:

Security: Look for exchanges with robust security measures such as two-factor authentication (2FA) and cold storage for funds.

Trading Fees: Compare the fees charged for buying and selling cryptocurrencies. Different exchanges have different fee structures.

Supported Cryptocurrencies: Ensure the exchange supports the cryptocurrencies you are interested in trading.

Payment Methods: Check if the exchange supports your preferred payment methods (e.g., credit cards, bank transfers, or other cryptocurrencies).

User Interface: Opt for an exchange with an intuitive and easy-to-navigate interface.

Customer Support: Good customer support is crucial in case you encounter any issues.

- Popular Exchanges:

Coinbase: A user-friendly platform ideal for beginners.

Binance: Offers a wide range of cryptocurrencies and advanced trading features.

Kraken: Known for its security and margin trading options.

- Actionable Takeaway: Research and compare multiple exchanges before making a decision. Read reviews and consider your specific needs and risk tolerance.

Setting Up Your Account and Funding It

Once you’ve chosen an exchange, you’ll need to create an account and fund it.

- Account Creation:

Provide the required personal information (name, address, date of birth, etc.).

Complete the Know Your Customer (KYC) verification process, which usually involves submitting identification documents like a passport or driver’s license.

Enable two-factor authentication (2FA) for added security.

- Funding Your Account:

Choose your preferred payment method (e.g., bank transfer, credit/debit card, or cryptocurrency).

Follow the exchange’s instructions to deposit funds into your account.

Be aware of any deposit fees or limits.

- Example: After creating an account on Coinbase and completing the KYC verification, you can link your bank account and transfer funds to your Coinbase wallet to start trading.

Understanding Crypto Trading Strategies

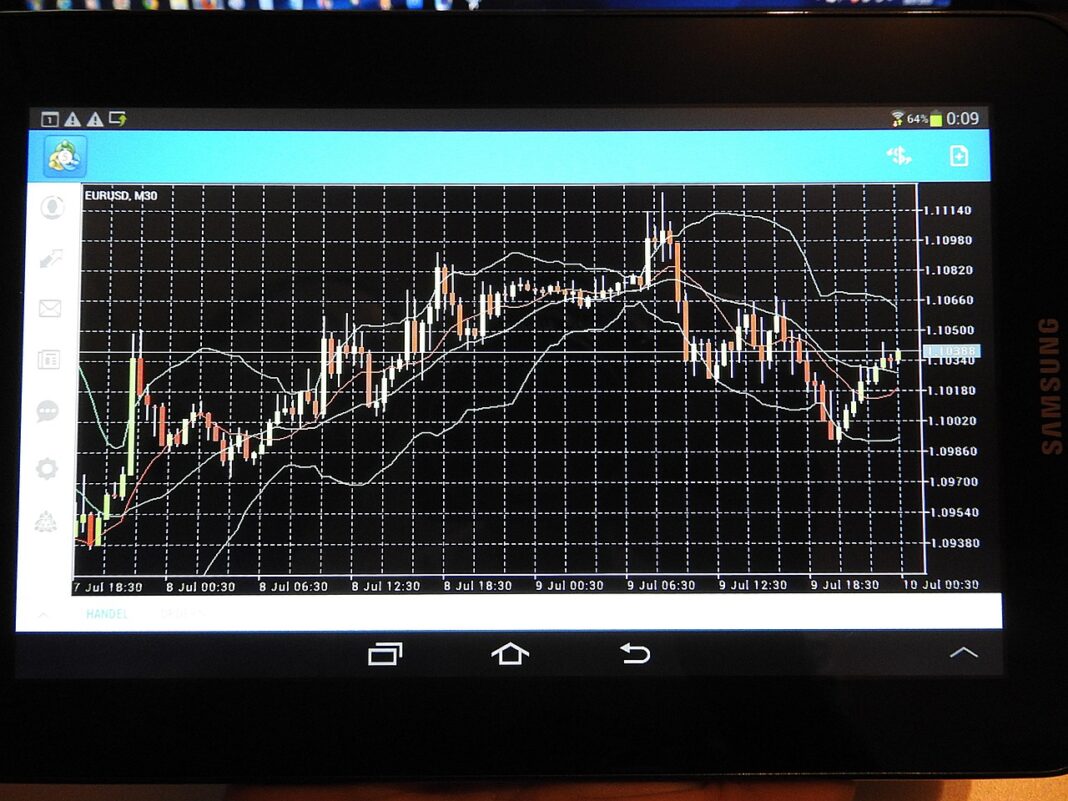

Technical Analysis

Technical analysis involves studying historical price charts and trading volumes to identify patterns and predict future price movements.

- Key Indicators:

Moving Averages (MA): Used to smooth out price data and identify trends.

Relative Strength Index (RSI): Measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

Moving Average Convergence Divergence (MACD): A trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

Fibonacci Retracement: Used to identify potential support and resistance levels.

- Chart Patterns:

Head and Shoulders: A bearish reversal pattern.

Double Top/Bottom: Indicates potential price reversals.

Triangles: Can be either continuation or reversal patterns.

- Example: If a cryptocurrency’s price crosses above its 200-day moving average, it could signal the beginning of an uptrend.

Fundamental Analysis

Fundamental analysis involves evaluating the intrinsic value of a cryptocurrency based on various factors.

- Key Factors:

Whitepaper: Understand the cryptocurrency’s purpose, technology, and roadmap.

Team: Assess the credibility and experience of the development team.

Market Capitalization: The total value of the cryptocurrency in circulation.

Use Case: Evaluate the real-world applications and potential of the cryptocurrency.

Partnerships: Look for strategic partnerships that can boost adoption and growth.

Tokenomics: Understand the token supply, distribution, and how the token functions within its ecosystem.

- Example: A cryptocurrency project with a strong development team, a clear use case, and increasing adoption is more likely to have long-term growth potential.

Trading Strategies

There are various trading strategies you can employ, depending on your risk tolerance and investment goals.

- Day Trading: Buying and selling cryptocurrencies within the same day to profit from small price fluctuations. This strategy requires constant monitoring and quick decision-making.

- Swing Trading: Holding cryptocurrencies for a few days or weeks to profit from larger price swings. This strategy requires more patience and a good understanding of market trends.

- Long-Term Investing (Hodling): Buying and holding cryptocurrencies for the long term, regardless of short-term price fluctuations. This strategy is based on the belief that the cryptocurrency will appreciate significantly in the future.

- Dollar-Cost Averaging (DCA): Investing a fixed amount of money at regular intervals, regardless of the price. This strategy helps to reduce the impact of volatility.

- Actionable Takeaway: Choose a trading strategy that aligns with your risk tolerance, investment goals, and available time.

Risk Management in Crypto Trading

Setting Stop-Loss Orders

Stop-loss orders are essential for limiting potential losses.

- What is a Stop-Loss Order? A stop-loss order is an instruction to automatically sell a cryptocurrency if its price falls below a specified level.

- How to Use Stop-Loss Orders: Set a stop-loss order at a level that you are comfortable losing. This will help to protect your capital in case the price moves against you.

- Example: If you buy Bitcoin at $30,000, you might set a stop-loss order at $28,000 to limit your potential losses to $2,000.

Diversification

Diversifying your portfolio can help to reduce risk.

- Don’t Put All Your Eggs in One Basket: Invest in a variety of cryptocurrencies, rather than concentrating your funds in a single asset.

- Consider Different Asset Classes: Diversify your portfolio by including other asset classes such as stocks, bonds, and real estate.

- Example: Instead of investing all your money in Bitcoin, consider also investing in Ethereum, Litecoin, and other promising altcoins.

Managing Emotions

Emotional trading can lead to poor decisions.

- Avoid Fear and Greed: Don’t let fear of missing out (FOMO) or panic selling influence your trading decisions.

- Stick to Your Plan: Follow your trading strategy and avoid making impulsive decisions based on short-term price fluctuations.

- Actionable Takeaway: Implement a robust risk management strategy to protect your capital and minimize potential losses.

Advanced Crypto Trading Techniques

Margin Trading

Margin trading allows you to trade with borrowed funds, amplifying your potential profits (and losses).

- How Margin Trading Works: You borrow funds from the exchange to increase your trading position. For example, with 5x leverage, a $100 investment can control $500 worth of cryptocurrency.

- Risks of Margin Trading: Margin trading is highly risky and can lead to significant losses if the market moves against you.

- Margin Call: If your position loses value and your account equity falls below a certain level, the exchange may issue a margin call, requiring you to deposit additional funds or liquidate your position.

- Warning: Margin trading is only suitable for experienced traders with a high-risk tolerance.

Futures Trading

Futures trading involves speculating on the future price of a cryptocurrency.

- How Futures Trading Works: You enter into a contract to buy or sell a cryptocurrency at a predetermined price on a future date.

- Leverage: Futures trading typically involves high leverage, which can amplify both profits and losses.

- Hedging: Futures contracts can be used to hedge against price volatility.

- Example: If you believe the price of Bitcoin will rise in the future, you can buy a Bitcoin futures contract. If the price increases, you will profit from the difference.

Automated Trading Bots

Automated trading bots can execute trades on your behalf based on predefined rules.

- Benefits of Trading Bots:

24/7 Trading: Bots can trade around the clock, even while you’re asleep.

Emotionless Trading: Bots eliminate emotional decision-making.

Backtesting: Bots can be backtested on historical data to evaluate their performance.

- Risks of Trading Bots:

Technical Issues: Bots can malfunction or experience technical issues.

Market Changes: Bots may not adapt well to sudden market changes.

Scams: Be wary of scam bots that promise unrealistic returns.

- Actionable Takeaway: Only use advanced trading techniques if you have a thorough understanding of the risks involved.

Conclusion

Trading cryptocurrency offers exciting opportunities, but it also requires knowledge, discipline, and a well-thought-out strategy. By understanding the fundamentals, choosing the right exchange, implementing robust risk management techniques, and continuously learning, you can increase your chances of success in the dynamic world of cryptocurrency trading. Remember to always invest responsibly and only risk what you can afford to lose.