Imagine a bustling digital marketplace, where instead of traditional money, everything runs on specialized tokens – each designed with a specific purpose and contributing to a larger, interconnected system. This is the essence of a token ecosystem, a dynamic and rapidly evolving space that’s reshaping industries from finance to gaming. Understanding these ecosystems is crucial for anyone involved in blockchain technology or exploring the future of digital economies.

Understanding Token Ecosystems

What is a Token Ecosystem?

A token ecosystem is a network centered around a specific token (or a group of tokens) that governs access, utility, or value within a defined environment. These ecosystems can be broad, spanning multiple platforms and services, or highly focused, tailored to a single application or community. The success of a token ecosystem hinges on the token’s utility, its adoption, and the overall health of the network it supports.

- Key Components:

The Token: The central asset, acting as a medium of exchange, access key, or store of value.

Users: Participants who interact within the ecosystem, driving demand and usage.

Developers: Creators who build applications and services that utilize the token.

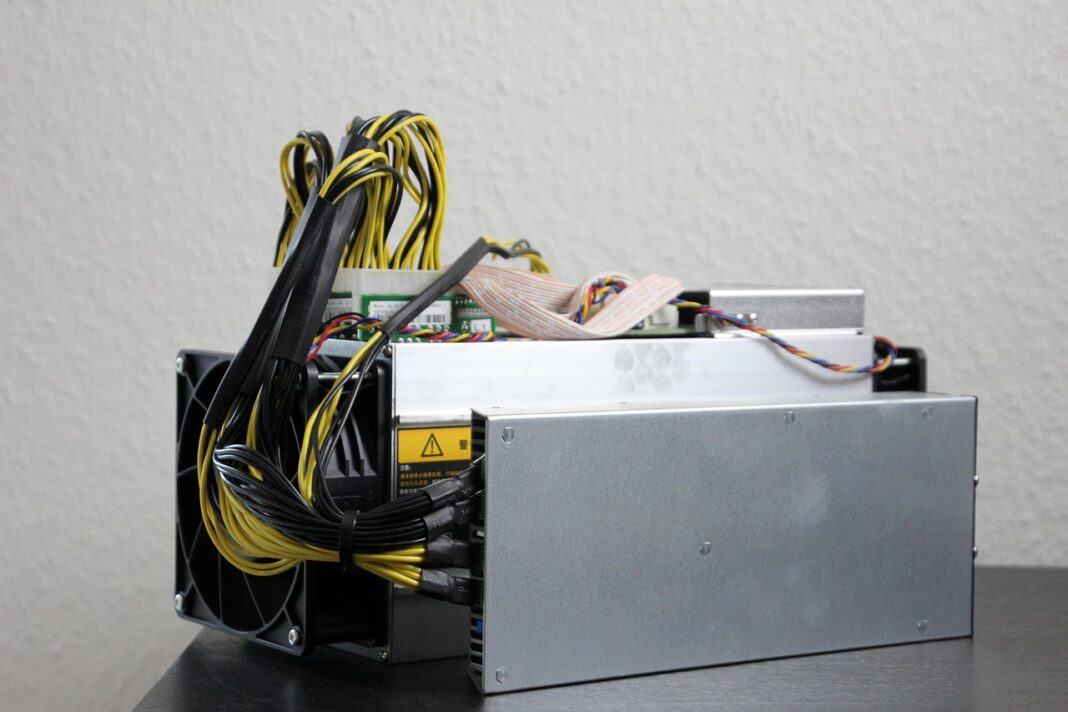

Infrastructure: The underlying blockchain or platform supporting the token’s functionality.

Governance: Mechanisms for managing and evolving the ecosystem.

How Token Ecosystems Differ from Traditional Systems

Unlike traditional, centralized systems, token ecosystems often leverage the principles of decentralization, transparency, and community ownership. This creates several key distinctions:

- Decentralization: Power is distributed amongst participants, reducing reliance on a single authority.

- Transparency: Blockchain technology ensures transaction data is publicly accessible and verifiable.

- Incentivization: Tokens can be used to reward contributions, encourage participation, and align interests within the ecosystem.

- Composability: The open-source nature of many blockchain projects allows different ecosystems to interact and build upon each other.

Key Elements of a Successful Token Ecosystem

Utility and Value Proposition

A strong token ecosystem requires a compelling utility for its token. This utility should solve a real problem or provide a unique benefit to its users. A clear value proposition is essential for driving adoption and sustaining long-term growth.

- Examples of Token Utility:

Governance Tokens: Giving holders voting rights on key decisions within a project. (Example: MakerDAO’s MKR token)

Utility Tokens: Granting access to specific features or services within a platform. (Example: Chainlink’s LINK token)

Payment Tokens: Facilitating transactions within an ecosystem. (Example: Bitcoin (BTC))

Reward Tokens: Incentivizing specific actions or contributions. (Example: Brave Browser’s BAT token)

Community and Governance

A vibrant community is crucial for the success of any token ecosystem. Active community participation, coupled with effective governance mechanisms, fosters growth, resilience, and innovation.

- Building a Strong Community:

Engage with users regularly: Use social media, forums, and community events to foster interaction.

Provide clear documentation and support: Help users understand the token’s utility and how to participate in the ecosystem.

Reward contributions: Recognize and reward active community members.

- Effective Governance Models:

Decentralized Autonomous Organizations (DAOs): Allow token holders to vote on proposals and manage the ecosystem’s resources.

On-chain Voting: Secure and transparent voting processes recorded directly on the blockchain.

Tokenomics and Sustainability

Tokenomics refers to the economics of a token, including its supply, distribution, and incentive mechanisms. A well-designed tokenomics model is essential for ensuring the long-term sustainability of the ecosystem.

- Key Tokenomic Considerations:

Token Supply: Determine the total number of tokens and how they will be distributed.

Inflation/Deflation: Decide whether the token supply will increase or decrease over time.

Staking and Rewards: Implement mechanisms for staking tokens and earning rewards.

Burning Mechanisms: Introduce ways to permanently remove tokens from circulation, potentially increasing their value.

Examples of Thriving Token Ecosystems

Ethereum (ETH)

Ethereum is arguably the most prominent example of a successful token ecosystem. Its native token, ETH, serves multiple purposes:

- Gas Fees: Paying for transaction fees on the Ethereum network.

- Staking: Securing the network and earning rewards through proof-of-stake consensus.

- Collateral: Used as collateral in decentralized finance (DeFi) applications.

The Ethereum ecosystem also hosts thousands of other tokens, each with its own unique utility and contributing to the overall vibrancy of the network.

Binance (BNB)

Binance’s BNB token is another excellent example. Initially created to reduce trading fees on the Binance exchange, it has since expanded its utility significantly.

- Trading Fees: Discounted trading fees on the Binance exchange.

- Binance Smart Chain (BSC): Used to pay for gas fees on the BSC network.

- Launchpad Participation: Required for participating in token sales on the Binance Launchpad.

Practical Tips for Participating in Token Ecosystems

Research Thoroughly

Before investing in any token ecosystem, conduct thorough research. Understand the token’s utility, the team behind the project, the community support, and the overall potential for long-term growth.

Understand the Risks

Token ecosystems are inherently risky. Prices can be highly volatile, and projects can fail. Never invest more than you can afford to lose.

Engage with the Community

Join the community forums, social media channels, and attend events to learn more about the ecosystem and connect with other participants.

Diversify Your Portfolio

Don’t put all your eggs in one basket. Diversify your investments across different token ecosystems to mitigate risk.

Conclusion

Token ecosystems are revolutionizing how we interact with digital assets and participate in online communities. By understanding the key elements of these ecosystems, including token utility, community governance, and sustainable tokenomics, you can navigate this exciting space and identify promising opportunities. Remember to conduct thorough research, understand the risks, and engage with the community to make informed decisions. The future of digital economies is being built on these interconnected networks, and understanding them is crucial for anyone seeking to participate in the next generation of innovation.