Crypto trading, a dynamic and rapidly evolving landscape, has captured the attention of investors worldwide. Whether you’re a seasoned trader or just beginning to explore the possibilities, understanding the nuances of cryptocurrency trading is crucial for navigating this exciting, yet complex, market. This comprehensive guide will break down the key aspects of crypto trading, from the basics to advanced strategies, empowering you to make informed decisions and potentially profit from the digital asset revolution.

Understanding Cryptocurrency Trading

What is Cryptocurrency Trading?

Cryptocurrency trading involves buying and selling cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and hundreds of others on various exchanges. The goal is to profit from the price fluctuations of these assets. Unlike traditional markets with set trading hours, crypto markets operate 24/7, 365 days a year, offering constant opportunities but also requiring constant vigilance.

- Speculation: Traders speculate on the future price movements of cryptocurrencies.

- Exchanges: Trading occurs on centralized exchanges (like Coinbase, Binance, Kraken) or decentralized exchanges (DEXs).

- Volatility: Cryptocurrency prices are known for their volatility, offering both high-risk and high-reward potential.

- Accessibility: Cryptocurrency trading is generally accessible to anyone with an internet connection and funds to invest.

Basic Terminology

Familiarizing yourself with common crypto trading terminology is essential:

- Bitcoin (BTC): The first and most well-known cryptocurrency.

- Altcoins: Any cryptocurrency other than Bitcoin.

- Blockchain: A distributed, decentralized, public ledger that records all transactions.

- Wallet: A digital tool used to store, send, and receive cryptocurrencies.

- Exchange: A platform where you can buy, sell, and trade cryptocurrencies.

- Liquidity: The ease with which an asset can be bought or sold without affecting its price.

- Volatility: The degree to which an asset’s price fluctuates.

- Market Cap: The total value of a cryptocurrency (price multiplied by circulating supply).

- ATH/ATL: All-Time High/All-Time Low.

Different Trading Styles

Different traders adopt different strategies based on their risk tolerance, time commitment, and financial goals:

- Day Trading: Buying and selling cryptocurrencies within the same day to capitalize on short-term price movements.

Example: A day trader might buy Bitcoin in the morning at $30,000 and sell it in the afternoon at $30,500, aiming for small but frequent profits.

- Swing Trading: Holding cryptocurrencies for several days or weeks to profit from larger price swings.

Example: A swing trader might hold Ethereum for a week, expecting a significant price increase based on market analysis.

- Scalping: Making numerous small trades throughout the day, aiming for very small profits on each trade. This is one of the most intense and difficult styles to maintain with consistency.

- Long-Term Investing (HODLing): Holding cryptocurrencies for months or years, believing in their long-term potential. “HODL” originated as a misspelling of “hold,” and is now an often used and celebrated term.

Example: Buying Bitcoin and holding it for several years, anticipating its value to increase significantly over time.

Getting Started with Crypto Trading

Choosing a Cryptocurrency Exchange

Selecting the right exchange is crucial for a smooth and secure trading experience. Consider these factors:

- Security: Look for exchanges with robust security measures, such as two-factor authentication (2FA), cold storage of funds, and insurance coverage.

- Fees: Compare trading fees, deposit fees, and withdrawal fees across different exchanges.

- Liquidity: Choose an exchange with high liquidity to ensure you can easily buy and sell cryptocurrencies.

- Supported Cryptocurrencies: Ensure the exchange supports the cryptocurrencies you want to trade.

- User Interface: Opt for an exchange with an intuitive and user-friendly interface, especially if you’re a beginner.

- Customer Support: Reliable customer support is essential in case you encounter any issues.

Popular exchanges include:

- Coinbase: A user-friendly platform, especially suitable for beginners.

- Binance: A global exchange with a wide range of cryptocurrencies and advanced trading features.

- Kraken: A reputable exchange known for its security and margin trading options.

Setting Up an Account

- Registration: Create an account on your chosen exchange.

- Verification: Complete the KYC (Know Your Customer) process by providing the required documentation, such as a government-issued ID and proof of address.

- Security: Enable two-factor authentication (2FA) to protect your account from unauthorized access.

Funding Your Account

- Deposit Methods: Most exchanges offer various deposit methods, including bank transfers, credit/debit cards, and cryptocurrency deposits.

- Fees: Be aware of any deposit fees charged by the exchange or your payment provider.

- Security: Ensure the deposit method is secure and trustworthy.

Developing a Trading Strategy

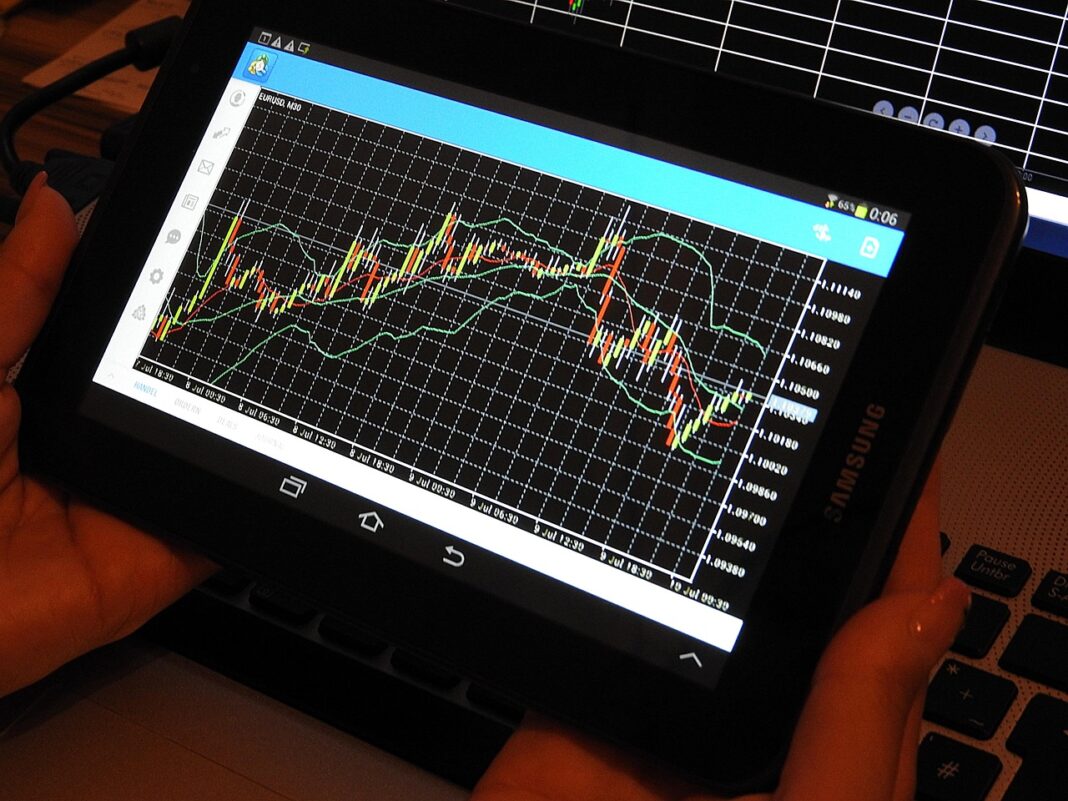

Technical Analysis

Technical analysis involves studying price charts and using various indicators to identify potential trading opportunities.

- Chart Patterns: Recognizing patterns like head and shoulders, double tops/bottoms, and triangles can help predict future price movements.

- Indicators: Popular technical indicators include:

Moving Averages (MA): Used to smooth out price data and identify trends.

Relative Strength Index (RSI): Measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

Example: An RSI reading above 70 suggests an overbought condition, potentially indicating a sell signal.

Moving Average Convergence Divergence (MACD): A trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

Fibonacci Retracement: Used to identify potential support and resistance levels based on Fibonacci ratios.

- Example: If a cryptocurrency’s price breaks above a resistance level identified using Fibonacci retracement, it could signal a potential buying opportunity.

Fundamental Analysis

Fundamental analysis involves evaluating the underlying factors that influence the value of a cryptocurrency.

- Whitepaper: Read the cryptocurrency’s whitepaper to understand its purpose, technology, and team.

- Market Sentiment: Gauge the overall sentiment towards the cryptocurrency through social media, news articles, and online forums.

- Use Case: Assess the real-world applications and utility of the cryptocurrency.

- Team and Development: Evaluate the team behind the cryptocurrency and their track record.

- Partnerships: Consider any significant partnerships or collaborations that could impact the cryptocurrency’s value.

Risk Management

Effective risk management is crucial for protecting your capital.

- Stop-Loss Orders: Set stop-loss orders to automatically sell your cryptocurrency if it reaches a certain price, limiting potential losses.

* Example: If you buy Bitcoin at $30,000, you might set a stop-loss order at $29,000 to limit your loss to $1,000.

- Position Sizing: Determine the appropriate amount of capital to allocate to each trade based on your risk tolerance.

- Diversification: Spread your investments across multiple cryptocurrencies to reduce the risk of losing everything on a single asset.

- Risk-Reward Ratio: Aim for a favorable risk-reward ratio, where the potential profit outweighs the potential loss. A common target is a 1:2 ratio or higher.

Advanced Crypto Trading Strategies

Margin Trading

Margin trading allows you to trade with borrowed funds, amplifying both potential profits and losses.

- Leverage: Exchanges offer different levels of leverage, such as 2x, 5x, or even 100x.

- Risk: Margin trading is highly risky and should only be used by experienced traders who understand the potential consequences.

- Example: With 10x leverage, a 10% price increase would result in a 100% profit, but a 10% price decrease would result in a 100% loss.

- Liquidation Price: If the price moves against your position, you could be liquidated, losing your initial investment.

Futures Trading

Futures trading involves buying and selling contracts that obligate you to buy or sell a cryptocurrency at a specific price on a future date.

- Hedging: Futures contracts can be used to hedge against potential price declines.

- Speculation: Futures contracts can also be used to speculate on future price movements.

- Perpetual Contracts: Perpetual contracts are a type of futures contract that do not have an expiration date.

Automated Trading Bots

Trading bots can automate your trading strategies, executing trades based on predefined rules.

- Backtesting: Before deploying a trading bot, backtest it on historical data to evaluate its performance.

- Customization: Most trading bots allow you to customize the trading strategies and risk parameters.

- Monitoring: Continuously monitor the performance of your trading bot and make adjustments as needed.

- Example: A bot could be configured to automatically buy Bitcoin when the RSI falls below 30 and sell when the RSI rises above 70.

Conclusion

Crypto trading presents a unique opportunity for investors to participate in the evolving digital asset market. By understanding the fundamentals, developing a well-defined trading strategy, and practicing effective risk management, you can increase your chances of success. However, it’s crucial to remember that crypto trading involves significant risks, and it’s essential to invest only what you can afford to lose. Continuous learning and adaptation are vital for navigating this dynamic and ever-changing landscape. Embrace the challenge, stay informed, and trade responsibly.